In today’s global economy, business owners must ship goods internationally with efficiency, transparency, and security. To facilitate air shipments, one of the most critical documents that business owners should understand is the Airway Bill (AWB). Despite its importance, many entrepreneurs are unaware of how the AWB impacts their logistics, from compliance to cost-effectiveness.

In this comprehensive guide, we will dive into what an AWB is, its components, and different types, how business owners can generate an AWB, and how to avoid common mistakes that can lead to costly errors or delays.

What is an Airway Bill (AWB)?

An Airway Bill (AWB) is a legally binding transport document that provides detailed information about goods shipped by air. It acts as a contract between the shipper and carrier and serves as a receipt of goods. AWBs ensure that the shipment follows regulations and reaches the destination securely, making it essential for businesses involved in international trade.

The AWB provides several crucial functions for air transport:

- It is a contract of carriage between the shipper and carrier.

- It serves as proof of receipt by the carrier.

- It offers tracking details for both the shipper and consignee.

- It ensures that the shipment complies with international air transport regulations.

Business owners who engage in air freight need to understand how to complete an AWB accurately, as it facilitates customs clearance and ensures a smooth shipping process.

What Are the Requirements for an Airway Bill (AWB)?

For an AWB to be valid, it must include a specific set of details. These details are crucial for tracking and compliance, ensuring that goods move smoothly through customs and reach their destination without issues.

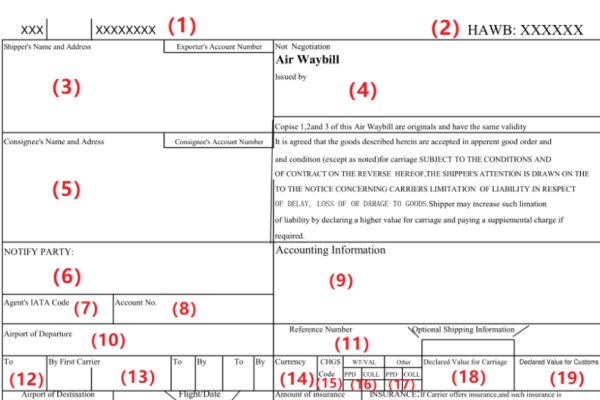

Key elements of an AWB include:

01 MAWB NO. (Master Air Waybill Number)

The master air waybill number consists of 11 digits. The first 3 digits represent the airline's three-digit code, and the last 8 digits consist of the master bill sequence code. The last digit is a check digit, calculated as the remainder of the first 7 digits divided by 7. The check digit can only be a number between 0 and 6. Additionally, there is typically a three-letter airport code between the third and fourth digits.

02 HAWB NO. (House Air Waybill Number)

The house air waybill number is usually displayed at the top right and bottom right corners of the house waybill. It does not have a fixed format and is created by the freight forwarder. It may include abbreviations of the forwarder’s name or other representative letters. If it is a master bill, this field will display the master number.

03 Shipper’s Name and Address

Fill in the shipper’s full name, address, and contact information (e.g., phone number, fax, email). The Shipper’s/Exporter’s Account Number is generally not required unless the carrier specifically requests it.

04 Air Waybill Issued by

For master waybills, this section will display the airline's name, logo, or code, indicating that the air waybill was issued by the airline. For house waybills, this section will display the freight forwarder’s title, logo, or other identifier, indicating the bill was issued by the forwarder. The term "Not Negotiable" means the air waybill is non-transferable.

05 Consignee’s Name and Address

Enter the consignee’s full name, address, and contact information (e.g., phone, fax, email). The Consignee’s Account Number is usually not required unless specifically requested.

06 NOTIFY PARTY

This section refers to the party to be notified upon the arrival of the shipment. In the case of house waybills, this refers to the agent who must be informed at the destination. If the consignee is the agent, you can write "SAME AS CONSIGNEE." For master waybills, this section usually lists the issuing carrier’s agent name and city, including the agent’s contact details.

07 Agent’s IATA Code

Enter the freight forwarder's IATA CASS (Cargo Accounts Settlement System) code. Some airlines use this code for internal system management.

08 Account No.

This section refers to the freight forwarder’s IATA settlement account. It should be filled in if required by the airline.

09 Accounting Information

This field often includes terms such as “FREIGHT PREPAID” or “FREIGHT COLLECT” to indicate how the freight is paid. If freight is paid in cash or by check, note it here.

10 Airport of Departure

Fill in the three-letter code or the full name of the departure airport.Such as CA

11 Reference Number

This is used to reference any relevant certificates or documents. If none, leave it blank.

12 To (Destination Airport)

Enter the three-letter code for the destination airport. If the flight involves transit, enter the first transit airport code.

13 By First Carrier-To-By-To-By

Enter the two-letter code of the first carrier. If the shipment involves multiple carriers, enter the second and third carrier codes and their corresponding airport codes in the following fields.

14 Currency

Indicate the currency used at the origin, such as CNY for Chinese Yuan.

15 CHGS Code (Charges Code)

This section is generally used for electronic transmission of air waybill information and is usually left blank on paper copies.

16 WT/VAL (Weight Charge/Valuation Charge Payment Method)

PPD (Prepaid) means all charges are paid in advance, and COLL (Collect) means charges are paid at the destination. Usually, the master air waybill is marked as "PPD," while the house waybill is marked as "COLL."

17 Other Charges Payment Method

Similar to WT/VAL, indicate whether other charges (such as handling fees) are prepaid or collected.

18 Declared Value for Carriage

This is the declared value of the goods for the carrier’s liability. If no value is declared, write “N.V.D” (No Value Declared).

19 Declared Value for Customs

This is the declared commercial value of the goods for customs clearance. If the goods have no declared commercial value, write “N.C.V” (No Commercial Value). If the invoice value is used for customs, write “AS PER INV.”

20 Airport of Destination

Fill in the full name or three-letter code of the destination airport. If unsure, you can write the full name of the city.

21 Flight/Date

Enter the flight number and departure date. If there is a connecting flight, include the second flight number and date as well.

22 Amount of Insurance

If the goods are insured by the airline or forwarder, enter the insured amount here. If no insurance is provided, write “NIL” or “XXX.”

23 Handling Information

Use this section to include any special handling requirements for the goods (e.g., whether the goods contain hazardous materials or require special packing). Contact details of the emergency contact can also be noted here.

24 No. of Piece RCP (Number of Pieces and Rate Combination Point)

Indicate the total number of pieces being shipped. RCP refers to the rate combination point, which applies when different rates are used for different parts of the shipment.

25 Gross Weight

Enter the gross weight of the shipment, typically to one decimal place.

26 Kg lb (Weight Unit)

Indicate the weight unit used: “K” for kilograms or “L” for pounds.

27 Rate Class

Enter the applicable rate class code. Common examples include M for Minimum Charge, N for normal rate, and Q for quantity rate.

28 Commodity Item No.

If the rate class is commodity-specific, enter the commodity item number here.

29 Chargeable Weight

The chargeable weight is the greater of the gross weight and the volumetric weight.

30 Rate/Charge

Enter the rate per unit of chargeable weight.

31 Total

Calculate and enter the total freight charges by multiplying the rate by the chargeable weight.

32 Nature and Quantity of Goods

Provide the description and quantity of goods in detail. If hazardous goods are involved, they must be listed first. General terms should be avoided; be as specific as possible.

33 Weight Charge

If the freight charge is prepaid, enter the amount in the Prepaid box; if it is collect, enter the amount in the Collect box.

34 Valuation Charge

Similar to the weight charge, if prepaid, enter the valuation charge in the Prepaid box; if collected, use the Collect box.

35 Tax

Enter the tax amount, with prepaid taxes listed under Prepaid and collect taxes under Collect.

36 Total Other Charges Due Agent

Enter the total of other charges due to the agent, depending on whether they are prepaid or collect.

37 Total Other Charges Due Carrier

Enter the total other charges due to the carrier, under Prepaid or Collect as applicable.

38 Total Prepaid/Total Collect

Add the total prepaid charges and the total collect charges and enter them in the respective boxes.

39 Currency Conversion Rates

Enter the conversion rate for the destination country’s currency.

40 CC Charges in Destination Currency

Calculate and enter the amount due in the destination country’s currency, based on the total collect charges.

41 Other Charges

List any additional charges, whether prepaid or collect, using appropriate codes (e.g., AWC for air waybill fee, MYC/FSC for fuel surcharge).

42 Signature of Shipper or his Agent

Enter the name of the shipper or freight forwarder and provide a signature or stamp.

43 Executed on-Date at-Place-Signature of Issuing Branch

Enter the date, place, and signature or stamp of the issuing branch. Dates are typically written in the day/month/year format.

44 Charges at Destination

This section is filled out by the carrier at the destination and includes any applicable charges.

45 Total Collect Charges

Enter the total collect charges due upon arrival.

These elements are essential to ensure the shipment is legally binding and follows international air freight regulations. AWBs are non-negotiable instruments, meaning they cannot be transferred to another party once issued.

Who Is Responsible for Filling Out the AWB?

The completion of the AWB is a shared responsibility between the shipper and the carrier.

- The shipper is responsible for providing accurate information regarding the goods, their quantity, value, and any special handling requirements.

- The carrier adds information related to the flight details, airline, and destination.

This dual responsibility ensures that the document is accurate and legally binding. The AWB acts as a contract of good faith, outlining both the shipper's and carrier's obligations and protecting them in case of disputes.

The carrier’s signature on the AWB acts as proof of receipt, ensuring that the carrier has taken responsibility for the shipment.

Types of Air Waybills: Master Air Waybill (MAWB) and House Air Waybill (HAWB)

Business owners who deal with air freight will come across two primary types of AWBs: the Master Air Waybill (MAWB) and the House Air Waybill (HAWB). Understanding the differences between these documents is crucial for managing logistics effectively.

- Master Air Waybill (MAWB):

- Issued directly by the airline.

- Serves as the contract between the shipper and the airline.

- It is used when the shipper contracts directly with the airline for transportation.

- House Air Waybill (HAWB):

- Issued by a freight forwarder.

- Represents the contract between the shipper and the freight forwarder.

- Used when a freight forwarder consolidates shipments from multiple shippers into one master shipment.

These distinctions are vital for business owners as they decide whether to work directly with an airline or through a freight forwarder.

How to Generate an AWB Number

The AWB number is a unique identifier that allows for tracking and documentation of the shipment. For business owners, understanding how to generate and manage an AWB number is key to effective logistics management.

AWB numbers can be generated manually or through digital tools. Many logistics companies use tools like the AWB Generator Chrome extension, which automatically generates valid AWB numbers that meet the required standards for international shipping.

An AWB number consists of:

- The airline code (3 digits).

- A serial number (8 digits).

For example, an AWB number might look like this: 123-12345678.

This unique number is used to track the shipment throughout its journey and provides transparency for the shipper, the carrier, and the consignee.

Why Is the AWB Important for Business Owners?

For business owners, the AWB plays a crucial role in ensuring the safe and legal transport of goods by air. Here are several reasons why an AWB is essential:

- Legally Binding Contract: The AWB acts as a contract of carriage, protecting both the shipper and the carrier in the event of disputes over lost or damaged goods.

- Митническо оформяне: The AWB provides customs authorities with the information needed to clear goods quickly and efficiently, reducing delays.

- Tracking: The AWB number allows business owners to track their shipments in real-time, ensuring transparency and minimizing the risk of lost or delayed goods.

- Документация: The AWB serves as a receipt of goods, ensuring that the shipment is properly documented from origin to destination.

For business owners engaging in international trade, the AWB is not just a formality; it’s a critical part of the shipping process that helps reduce risk and ensure compliance with regulations.

AWB Tracking: How Does It Work?

AWB tracking is an essential feature that allows business owners to monitor their shipments at every stage of the journey. By using the unique AWB number, shippers and consignees can access tracking updates through the carrier's website or a third-party logistics provider’s platform.

Tracking provides the following benefits:

- Real-time Updates: Receive live information about the shipment's location and status.

- Delivery Confirmation: Get notified when the shipment arrives at its final destination.

- Problem Alerts: If there are any delays or issues with the shipment, tracking allows for immediate alerts, so the shipper can take corrective action.

For business owners, tracking is not just about knowing where goods are—it’s about ensuring that the supply chain remains efficient and transparent.

Airway Bill vs Bill of Lading: What’s the Difference?

While both the Airway Bill (AWB) and the Bill of Lading (BOL) serve as shipping documents, they differ in significant ways, particularly regarding the modes of transport they cover and their legal status.

- Airway Bill (AWB):

- Specific to air freight.

- Non-negotiable, meaning it cannot be transferred to another party.

- Functions as a receipt, tracking tool, and contract of carriage.

- Bill of Lading (BOL):

- Used for sea, land, and multimodal transport.

- Can be negotiable, meaning ownership of the goods can be transferred.

- Serves as proof of ownership, a contract of carriage, and a document for claiming goods.

For business owners, knowing when to use an AWB or a BOL is crucial, depending on the mode of transport and the nature of the shipment.

The Transition from Paper AWB to e-AWB

The logistics industry is undergoing a digital transformation, and one of the most significant changes is the shift from paper-based AWBs to electronic AWBs (e-AWB). This shift is designed to improve efficiency and reduce errors in the shipping process.

Benefits of e-AWBs for Business Owners:

- Reduced Paperwork: With e-AWBs, there’s no need to print and manually sign physical documents, reducing administrative work.

- Faster Processing: Electronic documentation can be processed faster than traditional paper AWBs, speeding up the shipping process.

- Fewer Errors: Digital forms reduce the likelihood of errors caused by manual data entry.

For business owners, adopting e-AWBs can result in significant time savings and increased accuracy in logistics operations.

Common Mistakes to Avoid When Using an AWB

Even though filling out an AWB might seem straightforward, business owners often make common mistakes that can lead to delays, disputes, or additional costs. Here are some key mistakes to avoid:

- Inaccurate Information: Providing incorrect details about the shipment, such as the wrong consignee or incorrect declared value, can lead to delays or disputes.

- Incomplete Documentation: Failing to include critical information like special handling instructions can cause issues during transport.

- Ignoring Customs Regulations: Each country has its own set of customs requirements. Ensuring that your AWB complies with these regulations is crucial for smooth shipping.

- Forgetting to Insure the Shipment: Not including insurance details in the AWB leaves the shipment unprotected in case of damage or loss.

By avoiding these mistakes, business owners can ensure a smoother, more efficient shipping process.

Conclusion

In conclusion, an Airway Bill (AWB) is an indispensable document for business owners involved in international air shipments. From ensuring that goods are shipped securely and on time to providing a legal framework for transport, the AWB plays a crucial role in modern logistics. By understanding its requirements, types, and tracking capabilities, businesses can streamline their shipping processes and avoid costly mistakes.

For businesses that ship goods via air, the AWB is more than just a document—it's a critical tool for ensuring that shipments arrive safely and on time, with all legal requirements met.