In the ever-expanding world of international trade, the process of getting goods from one country to another can be complex and challenging. Customs duties, taxes, shipping logistics, and compliance with regulations can create roadblocks for both buyers and sellers. To simplify this process, a set of standardized trade terms known as Incoterms was created. These terms help both parties clearly define their responsibilities in shipping transactions, including the transfer of risks, costs, and duties.

One of the most comprehensive Incoterms is Delivered Duty Paid (DDP), where the seller takes full responsibility for all costs associated with delivering the goods to the buyer. From export duties to import clearance, DDP allows buyers to receive their goods without worrying about hidden fees or customs complications. This article offers a comprehensive guide to DDP, exploring its benefits, challenges, and best practices in international trade.

Understanding Incoterms and Their Role in International Trade

What are Incoterms? Incoterms, short for International Commercial Terms, are a set of globally recognized trade terms established by the International Chamber of Commerce (ICC). Introduced in 1936, Incoterms standardize the roles of sellers and buyers in international transactions, helping parties avoid misunderstandings and disputes regarding shipping costs and risks. Each term defines which party is responsible for tasks such as shipping, customs clearance, import/export duties, and the risk of goods in transit.

The Importance of Incoterms in Global Trade Incoterms simplify cross-border transactions by clarifying the obligations of both the buyer and the seller. Without a common set of rules, there would be confusion about who is responsible for shipping costs, insurance, and customs duties, which could lead to costly delays and legal issues. Incoterms facilitate smooth transactions by providing clear guidelines for international trade partners, and they are revised periodically to account for changes in global commerce.

Overview of Common Incoterms Incoterms can be grouped based on where the risk and responsibility shift from the seller to the buyer. Some of the most commonly used Incoterms in international trade include:

- Ex Works (EXW): The buyer is responsible for all transport and customs duties from the seller's warehouse.

- Free on Board (FOB): The seller handles costs and risks up to the point where goods are loaded onto the shipping vessel.

- Cost, Insurance, and Freight (CIF): The seller covers the cost, insurance, and freight up to the port of destination, while the buyer is responsible for import duties and further transportation.

Delivered Duty Paid (DDP) stands out from these terms because it places the maximum responsibility on the seller, from the origin of goods all the way to delivery at the buyer’s location, including all duties and taxes.

What is Delivered Duty Paid (DDP)?

Delivered Duty Paid (DDP) is an Incoterm that represents one of the most seller-heavy arrangements in international trade. In a DDP transaction, the seller assumes complete responsibility for delivering the goods to the buyer’s location. This includes all shipping costs, insurance, customs duties, import taxes, and even last-mile delivery.

Seller’s Responsibilities Under DDP

- Shipping and Freight: The seller arranges for the transportation of goods from their warehouse to the buyer’s location, covering all associated costs.

- Customs Clearance: The seller must ensure that goods are cleared through customs both in the export country and the import country. This often requires providing all necessary documentation, such as commercial invoices, bills of lading, and certificates of origin.

- Payment of Duties and Taxes: The seller pays all applicable export and import duties, as well as taxes like value-added tax (VAT) or sales tax, depending on the destination country.

- Insurance: It is generally expected that the seller provides insurance for the goods throughout the shipping process, though this depends on the specific agreement between the parties.

- Final Delivery: The seller must ensure that the goods are delivered to the buyer’s specified location, whether that’s a warehouse, distribution center, or doorstep.

How DDP Compares to Other Incoterms DDP places a greater burden on the seller than other Incoterms like Free on Board (FOB) or Cost and Freight (CFR), where the buyer is responsible for customs clearance and import duties. By choosing DDP, the seller commits to delivering the goods in full compliance with the destination country’s customs regulations. For buyers, this is an attractive option because it eliminates the risk of unexpected customs charges or delays.

Buyer’s Role in a DDP Transaction Under DDP, the buyer has minimal responsibilities. Once the seller has delivered the goods to the agreed location, the buyer simply receives the goods without any additional costs. This hands-off approach is particularly appealing to buyers unfamiliar with complex customs procedures.

Step-by-Step Process of a DDP Shipment

A DDP shipment follows a multi-step process, each of which must be carefully managed by the seller. Here is a detailed breakdown of how a typical DDP shipment works from start to finish:

- Order Placement When a buyer places an order with a seller under DDP terms, both parties agree on the total price, which includes all shipping, insurance, and customs duties. It’s essential that both sides clearly define the terms in a contract to avoid any misunderstandings later in the process.

- Packaging and Export Preparation Once the order is confirmed, the seller is responsible for preparing the goods for shipment. This includes proper packaging and labeling to ensure that the goods meet international shipping standards. In addition, the seller must gather the required documents, such as the commercial invoice, packing list, and certificate of origin, all of which are needed for customs clearance.

- Export Customs Clearance Before the goods leave the seller’s country, they must be cleared for export. This involves submitting the necessary paperwork to the local customs authorities and paying any applicable export duties or taxes. The seller must ensure compliance with all export regulations to avoid delays.

- Freight and Shipping After export clearance, the seller arranges for transportation. This could involve shipping by air, sea, rail, or road, depending on the destination and nature of the goods. The seller is also responsible for purchasing insurance to cover the goods while they are in transit, protecting against potential loss or damage.

- Import Customs Clearance When the goods arrive in the destination country, the seller must handle all import customs procedures. This can be one of the most complex parts of the process, as different countries have different regulations regarding import duties, taxes, and required documentation. The seller is responsible for paying import duties and taxes, as well as any other fees required by the local authorities.

- Final Delivery Once the goods have cleared customs, the seller arranges for their transportation to the buyer’s specified location. This could involve last-mile delivery services to a warehouse, distribution center, or the buyer’s doorstep. The seller remains responsible for the goods until they have been successfully delivered.

This step-by-step process highlights the high level of responsibility that the seller undertakes in a DDP transaction, ensuring that the buyer receives their goods without any logistical hurdles or hidden costs.

Key Responsibilities in a DDP Agreement

Delivered Duty Paid (DDP) places significant responsibilities on the seller, far more than other Incoterms like Ex Works (EXW) or Free on Board (FOB). The DDP arrangement mandates that the seller handle every aspect of the shipping process, from the seller's factory to the buyer's location, with all duties and taxes fully covered.

Seller’s Responsibilities

- Transportation and Shipping

The seller must arrange and pay for the transportation of goods from the point of origin to the final destination. This involves:

- Booking freight with reliable shipping carriers.

- Organizing intermodal transportation if necessary (e.g., combining sea, air, or road transport).

- Managing the logistics of both loading and unloading at various points during transit.

- Customs Clearance

The seller is responsible for both export customs clearance in their own country and import customs clearance in the buyer’s country. This requires an in-depth understanding of both countries’ customs regulations and documentation requirements, including:

- The commercial invoice, which outlines the value and contents of the shipment.

- A packing list detailing the shipped goods.

- Import licenses, if required by the destination country.

- Certificates of origin to determine where the goods were manufactured, which can affect duties and tariffs.

- Import Duties and Taxes

In addition to paying for customs clearance, the seller must cover all import-related costs, including:

- Import duties or tariffs, which vary depending on the destination country’s regulations and the type of goods being shipped.

- Value-added tax (VAT) or sales tax, which is often required upon entry into the country.

- Any additional fees, such as customs inspection fees, brokerage fees, or port handling charges.

- Delivery to the Buyer

The seller’s responsibility doesn’t end at customs. They are obligated to deliver the goods to the buyer’s specified location, which could involve hiring local couriers or transport services to complete the last leg of the journey. This is referred to as last-mile delivery and can include:

- Unloading the goods at the buyer’s warehouse or designated site.

- Ensuring the goods arrive undamaged and within the agreed-upon timeframe.

Buyer’s Responsibilities

The buyer’s role under DDP is minimal. The buyer is only required to:

- Provide the seller with a clear delivery address.

- Accept delivery of the goods.

- There may be some cases where the buyer has to assist with providing local information for import documentation, but this is rare.

Advantages of Using DDP

DDP offers several key advantages, particularly for the buyer, but it can also benefit the seller in specific circumstances. Let's explore these advantages for both parties.

For the Buyer:

- Simplified Purchase Process

The biggest advantage for the buyer in a DDP arrangement is that it simplifies the entire process of purchasing goods internationally. Since the seller handles everything — including shipping, customs, and duties — the buyer can focus on their business operations without worrying about navigating complex regulations in a foreign country. This is particularly advantageous for businesses that are new to importing or lack experience with international shipping logistics. - Cost Transparency

Under DDP, the price quoted by the seller includes all costs related to getting the goods to the buyer's location. This means that the buyer knows exactly how much they will pay, with no hidden charges or surprise fees after the goods arrive. By offering an all-inclusive price, the seller eliminates the risk of unexpected customs duties, import taxes, or shipping surcharges, which can often lead to disputes or delays. - Reduced Risk of Customs Complications

Customs clearance can be a complex and time-consuming process, especially when shipping to countries with stringent regulations or high tariffs. By placing the responsibility for customs clearance on the seller, DDP eliminates the risk of the buyer facing customs delays, fines, or legal issues. The seller is expected to have the expertise needed to handle these issues, ensuring that the goods pass through customs smoothly and quickly. - Risk-Free Delivery

Because the seller is responsible for the goods until they are delivered to the buyer's specified location, the buyer is protected against the risk of damage or loss during transit. If the goods are damaged, delayed, or lost, it is the seller's responsibility to resolve the issue, either by replacing the goods or arranging a refund. This added level of protection makes DDP an attractive option for buyers who want to minimize their risk in international transactions.

For the Seller:

- Competitive Advantage

Offering DDP can be a major selling point, especially for sellers looking to attract international buyers. By providing a hassle-free purchasing experience, sellers can differentiate themselves from competitors who may require the buyer to handle customs clearance and import duties. This is particularly important in industries where buyers may be less familiar with international shipping regulations, such as e-commerce, fashion, or consumer goods. - Market Penetration

For sellers looking to expand into new international markets, offering DDP terms can be an effective way to break down barriers to entry. By assuming all responsibility for shipping and customs clearance, the seller can make their goods more accessible to buyers in countries with complex or opaque import regulations. This can help sellers establish a foothold in new markets and build trust with local customers. - Control Over the Shipping Process

While DDP places a significant burden on the seller, it also gives them full control over the shipping process. This means that the seller can ensure that the goods are transported by reliable carriers, properly insured, and handled with care throughout the journey. This level of control can reduce the risk of damage or delays, ensuring that the goods arrive in good condition and on time.

Challenges and Risks for Sellers in DDP Transactions

While DDP offers significant advantages for buyers, it can present a number of challenges and risks for sellers. These challenges stem from the fact that DDP requires the seller to take on a high level of responsibility for the entire shipping and customs process, which can lead to financial and logistical difficulties, especially when dealing with complex international markets.

- Customs Complications

One of the biggest risks for sellers using DDP is the possibility of encountering customs complications in the destination country. Every country has its own customs regulations, import duties, and taxes, which can vary widely depending on the type of goods being shipped. If the seller is unfamiliar with the import laws of the buyer's country, they may face delays, fines, or additional costs due to non-compliance.

For example, some countries require specific documentation or licenses to import certain goods, and failure to provide these documents can result in the shipment being held at customs. Additionally, customs authorities in some countries may impose unexpected fees or inspections, which can further delay the delivery and increase costs for the seller.

- Fluctuating Tariffs and Duties

Import duties and tariffs can change frequently, especially in countries with volatile economic or political climates. A seller may agree to a DDP price based on current duty rates, only to find that the rates have increased by the time the goods arrive at the destination. This can lead to significant financial losses for the seller, as they are responsible for covering any additional costs.

To mitigate this risk, sellers need to stay informed about potential changes in import duties and tariffs in the markets they serve. In some cases, sellers may include a clause in the sales contract that allows for adjustments in the DDP price if tariffs or duties change before delivery.

- Lack of Local Knowledge

Sellers who are not familiar with the local market or customs regulations in the buyer's country may struggle to navigate the complexities of customs clearance. This is particularly challenging in countries with strict import regulations or high levels of bureaucracy. In such cases, the seller may need to hire local customs brokers or legal experts to ensure compliance, which can add to the cost of the transaction.

In addition to regulatory issues, sellers may face logistical challenges when delivering goods to countries with poor infrastructure or difficult transportation networks. For example, delivering goods to remote areas in developing countries may require additional coordination and expenses, such as hiring local couriers or securing special permits for transportation.

- Currency and Exchange Rate Risk

When selling internationally, fluctuations in exchange rates can have a significant impact on the final cost of a DDP transaction. If the seller agrees to a DDP price in the buyer's local currency, they may be exposed to exchange rate fluctuations that could reduce their profit margin. For instance, if the seller agrees to a price in a foreign currency and that currency weakens against their own currency by the time of payment, the seller could receive less value for the goods.

To minimize this risk, sellers can hedge against currency fluctuations by using forward contracts or setting the price in their own currency. However, this may not always be possible if the buyer prefers to pay in their local currency.

- Financial Risk and Reduced Profit Margins

Because the seller assumes all costs related to shipping, customs, and duties, DDP can significantly reduce their profit margins, especially in countries with high tariffs or complicated customs procedures. The seller must carefully calculate all potential costs when setting the DDP price to ensure that they are not left with unexpected expenses that could erode their profits.

In some cases, the seller may find that the cost of offering DDP outweighs the benefits, particularly if they are shipping low-margin goods or dealing with countries that impose high import taxes. Sellers need to weigh the advantages of offering DDP against the potential financial risks and determine whether this Incoterm is the best fit for their business model.

Industries and Markets That Commonly Use DDP

The use of Delivered Duty Paid (DDP) as an Incoterm is widespread across many industries, but it is particularly favored in sectors where buyers demand simplicity and convenience in their purchasing process. DDP is ideal for industries that deal with high-value goods, complex logistics, or consumer-oriented products. Below are some key industries where DDP is commonly used, along with examples of how it benefits both sellers and buyers.

- E-commerce and Retail

With the rise of global e-commerce, DDP has become a critical Incoterm for sellers looking to attract international buyers. Online retailers, especially those dealing in consumer goods, frequently use DDP to provide customers with a seamless and transparent shopping experience. Offering DDP allows e-commerce platforms to include all shipping, taxes, and import duties in the final purchase price, so customers know exactly what they are paying without worrying about unexpected fees at delivery.

Example: A consumer in the U.S. purchasing a fashion item from an online retailer in Europe under DDP terms can complete their purchase without needing to worry about customs duties, VAT, or other import fees. The seller handles all aspects of the transaction, ensuring the item arrives at the consumer's door without delays.

- Automotive and Heavy Machinery

In industries that deal with high-value products, such as the automotive and heavy machinery sectors, DDP is commonly used to ensure that expensive and complex shipments arrive without legal or logistical issues. Buyers of vehicles, equipment, or large machinery often prefer DDP to avoid dealing with import formalities, which can be time-consuming and costly.

Example: A construction company in Brazil purchasing heavy-duty equipment from a manufacturer in Germany might opt for DDP to avoid the complexities of customs clearance and import duties. The manufacturer takes responsibility for shipping, customs clearance, and delivery, allowing the buyer to focus on its core business operations.

- Luxury Goods and Fashion

The luxury goods and fashion industries often use DDP to ensure a premium customer experience. Customers who purchase high-end products expect a smooth and hassle-free transaction. DDP allows luxury retailers to offer their clients an all-inclusive price, ensuring that customs duties and taxes are taken care of in advance.

Example: A luxury watch brand shipping products to customers around the world might use DDP to guarantee that the high-value goods pass through customs without delays or additional charges to the customer, maintaining the brand's reputation for exclusivity and premium service.

- Pharmaceuticals and Medical Equipment

The pharmaceutical and medical equipment industries often involve highly regulated products, where customs clearance can be complex and time-sensitive. DDP allows sellers in this sector to ensure their goods reach hospitals, clinics, or distributors without delays caused by customs or import issues.

Example: A hospital in India purchasing specialized medical equipment from a U.S. supplier might require DDP to ensure that the shipment, which may include temperature-sensitive items, arrives without any complications or delays due to import regulations.

How to Calculate DDP Costs

Calculating the total cost of a transaction under DDP terms requires careful consideration of all the expenses the seller must bear, from shipping and insurance to import duties and taxes. Here's a step-by-step guide on how to accurately calculate DDP costs.

- Shipping Costs

The seller is responsible for all shipping costs, including:

- Freight charges: The cost of transporting goods from the seller's warehouse to the buyer's location, whether by air, sea, or land. The seller must choose the most cost-effective and reliable shipping method.

- Handling fees: Charges for loading and unloading the goods during transit, especially if intermodal transportation (multiple types of transport) is used.

- Insurance Costs

In DDP, the seller is often required to insure the goods until they reach the buyer’s specified location. The cost of insurance will depend on:

- Value of the goods: Higher-value goods require more comprehensive insurance coverage.

- Risk factors: Shipments to countries with unstable political environments or difficult transportation networks may result in higher insurance premiums.

- Customs Duties

One of the most significant components of DDP costs is import duties, which vary depending on the country and the type of goods being shipped. To calculate customs duties, sellers should consider:

- Customs classification of goods: Goods are classified under the Harmonized System (HS) code, which determines the applicable duty rates.

- Country of origin: Some countries have trade agreements that reduce or eliminate duties for goods originating from certain nations.

- Value of goods: Duties are usually calculated as a percentage of the total value of the goods being imported.

Example: Calculating Import Duties

Imagine a seller shipping electronics to a buyer in the European Union. The goods are classified under an HS code that attracts a 10% duty rate, and the shipment’s total value is $50,000. In this case, the seller would be responsible for paying $5,000 in import duties to the EU authorities.

- Taxes (e.g., VAT or Sales Tax)

In addition to duties, many countries charge taxes on imported goods, such as Value-Added Tax (VAT) or sales tax. VAT rates differ between countries, and the seller must account for these taxes when calculating DDP costs.

For example, in many EU countries, VAT can range from 17% to 25% of the value of the goods. In a DDP transaction, the seller pays this tax upfront, so it must be factored into the overall price of the goods.

- Customs Brokerage Fees

Many sellers opt to use a customs broker to handle the intricacies of customs clearance in the destination country. Customs brokers assist with paperwork, classification of goods, and communication with customs authorities. The cost of using a broker can vary based on the complexity of the shipment and the destination country’s customs requirements. - Additional Fees and Contingencies

- Port handling fees: Charges imposed by the port or terminal for handling goods during unloading.

- Inspection fees: Some countries require goods to be inspected by customs authorities, which can add to the overall cost.

- Storage fees: If goods are held at customs for an extended period, the seller may incur storage fees.

Example: Full DDP Cost Calculation

Let’s say a U.S. manufacturer is shipping a $100,000 order of machinery to a buyer in Germany. The calculation might look like this:

- Freight costs: $3,000

- Insurance: $1,500

- Import duties (5%): $5,000

- VAT (19%): $19,000

- Customs brokerage fees: $1,000

In this example, the total DDP cost would be:

$100,000 + $3,000 + $1,500 + $5,000 + $19,000 + $1,000 = $129,500.

This full cost must be reflected in the price offered to the buyer under DDP terms, ensuring the seller covers all expenses.

DDP vs. Other Incoterms: A Comparison

When deciding which Incoterm to use in an international transaction, it’s important to weigh the benefits and responsibilities of DDP against other commonly used Incoterms. Here’s how DDP compares to several other Incoterms:

- DDP vs. Ex Works (EXW)

Ex Works (EXW) is essentially the opposite of DDP in terms of responsibility. Under EXW, the seller's responsibility ends as soon as the goods are made available for pickup at their facility. From that point, the buyer assumes all responsibility for transport, export customs clearance, import customs, duties, and final delivery.

- Advantages of EXW for the seller: EXW minimizes the seller's risk and involvement in the shipping process. The seller is only responsible for making the goods available at their location, and the buyer handles everything else.

- Advantages of DDP for the buyer: DDP, by contrast, puts the onus on the seller to ensure smooth delivery. It’s more convenient for buyers who may not want to deal with customs or international shipping logistics.

- DDP vs. Free on Board (FOB)

Free on Board (FOB) is one of the most commonly used Incoterms, especially in sea freight. Under FOB, the seller is responsible for delivering the goods to the port of shipment and ensuring they are loaded onto the vessel. After that, the buyer assumes responsibility for the goods, including shipping, insurance, import customs clearance, and delivery.

- Advantages of FOB for the seller: FOB allows the seller to pass responsibility to the buyer once the goods are on the shipping vessel, reducing the seller’s exposure to risk during transit.

- Advantages of DDP for the buyer: DDP eliminates the buyer's responsibility for import customs and shipping logistics, making it ideal for buyers who prefer an all-inclusive price and hassle-free delivery.

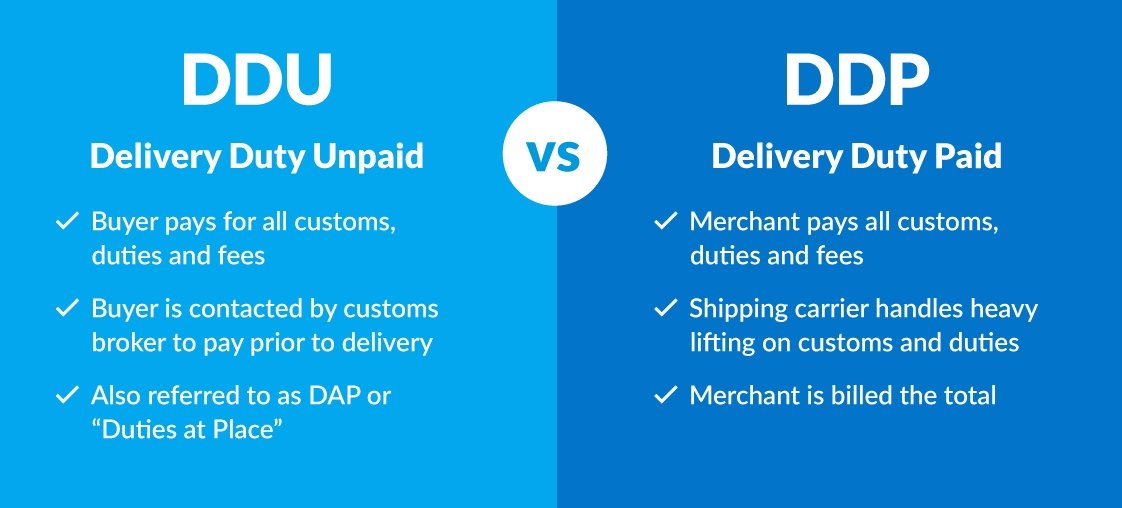

- DDP vs. Delivered at Place (DAP)

Delivered at Place (DAP) is similar to DDP, with one key difference: while the seller is responsible for delivering the goods to the buyer's specified location, the buyer is responsible for handling import customs clearance and paying any import duties and taxes.

- Advantages of DAP for the seller: DAP reduces the seller's burden by transferring customs clearance and import duties to the buyer, while still providing door-to-door delivery.

- Advantages of DDP for the buyer: DDP takes things one step further by ensuring the seller handles customs clearance, making it even more buyer-friendly than DAP.

- DDP vs. Delivered at Place Unloaded (DPU)

Delivered at Place Unloaded (DPU) requires the seller to deliver the goods and unload them at the buyer's location. However, like DAP, the buyer is responsible for customs clearance and import duties. DPU is often used when the buyer has the infrastructure to handle customs but needs help with unloading large or complex goods.

Legal and Regulatory Considerations in DDP Transactions

While Delivered Duty Paid (DDP) is one of the most convenient Incoterms for buyers, it comes with significant legal and regulatory challenges for sellers. These challenges primarily involve navigating complex customs regulations, understanding tax laws in foreign markets, and ensuring compliance with international trade rules. Here are some key legal and regulatory factors that sellers need to consider when using DDP in their transactions.

- Customs Regulations

Each country has its own set of customs laws and regulations, which can be both time-consuming and difficult to navigate. Sellers using DDP must be familiar with:

- Import restrictions: Some countries have specific restrictions or bans on certain goods, especially products like electronics, pharmaceuticals, or agricultural products. Sellers need to ensure their goods comply with local regulations.

- Documentation requirements: Sellers must provide the correct customs documentation, such as commercial invoices, bills of lading, and certificates of origin. Mistakes or omissions in paperwork can result in delays, fines, or even confiscation of goods.

- Tariff classifications: Goods are classified using Harmonized System (HS) codes, which determine the import duties that apply. Using incorrect codes can lead to overpayment of duties or penalties.

- Tax Laws and Compliance

In a DDP transaction, the seller is responsible for paying all applicable taxes, including value-added tax (VAT) or goods and services tax (GST). However, tax rates and rules can vary significantly across countries, and non-compliance can result in penalties or delayed deliveries. Sellers need to:

- Understand local tax rates: VAT rates differ from country to country, ranging from around 5% to 25%. Sellers must ensure that they calculate these taxes correctly when offering a DDP price.

- Register for VAT in foreign markets: In some countries, sellers may need to register for VAT or GST to pay these taxes on behalf of their customers. This process can involve filing additional paperwork and navigating local tax authorities.

- Reclaiming VAT: In certain cases, sellers may be able to reclaim VAT paid on imported goods. However, this requires understanding local tax laws and filing claims with the relevant authorities.

- Licensing and Trade Compliance

Some goods require special licenses or permits for export or import, particularly in industries like defense, pharmaceuticals, or chemicals. Sellers must ensure that they have the appropriate export licenses and that their goods comply with both domestic and international trade regulations. Failure to obtain these licenses can lead to fines or shipment delays. - Risk of Legal Disputes

Since DDP places a significant burden on the seller, there is always a risk of legal disputes if the goods are delayed, damaged, or fail to clear customs. Sellers can mitigate these risks by:

- Using clear contracts: Including detailed terms in sales contracts that outline each party’s responsibilities.

- Hiring customs brokers: Working with local experts to handle customs clearance can help ensure compliance and avoid delays.

DDP in the E-Commerce Era

As global e-commerce continues to grow, the use of Delivered Duty Paid (DDP) is becoming more prevalent among online retailers and marketplaces. The convenience of DDP makes it a popular choice for businesses looking to offer a seamless shopping experience to international customers, where all shipping, duties, and taxes are handled by the seller. Let’s explore how DDP fits into the modern e-commerce landscape and why it’s favored by both sellers and buyers.

- Global Reach and Customer Satisfaction

E-commerce platforms that sell to international customers face a key challenge: navigating the complexities of cross-border logistics, customs duties, and taxes. By offering DDP, sellers can eliminate many of these pain points for their customers, improving the overall shopping experience. With DDP:

- Customers know exactly what they will pay upfront, as all costs are included in the purchase price. This transparency reduces the risk of cart abandonment due to unexpected charges.

- Buyers avoid the hassle of dealing with customs clearance, which can be intimidating for individuals unfamiliar with international trade rules.

For example, major online retailers like Amazon and Alibaba have adopted DDP for certain markets to ensure customers receive their goods without delays or additional fees.

- Impact on E-commerce Business Models

For small to medium-sized online businesses, DDP can be a competitive advantage, especially in highly competitive markets where international customers expect hassle-free service. Here’s how DDP benefits e-commerce sellers:

- Simplified logistics: By handling all aspects of shipping and customs clearance, sellers can reduce the number of failed deliveries or customer complaints due to customs delays.

- Enhanced trust: DDP builds trust with international customers, as they are more likely to purchase from a retailer that offers a straightforward, all-inclusive pricing model.

- Increased conversions: By removing the uncertainty of customs fees and taxes, DDP can lead to higher conversion rates. Customers are more likely to complete a purchase when they know there are no hidden costs after the initial checkout.

- Challenges for E-commerce Sellers

While DDP offers significant benefits, it also presents several challenges for e-commerce sellers:

- Cost calculation: Accurately calculating duties and taxes for different countries can be difficult, especially for small businesses that lack expertise in international trade.

- Logistics management: Managing logistics for global customers can be costly and complex, particularly when dealing with returns or exchanges.

- Customs regulations: E-commerce sellers need to stay updated on customs regulations and ensure compliance across different countries, which can add administrative overhead.

For these reasons, many e-commerce sellers partner with third-party logistics providers, customs brokers, or e-commerce platforms that offer DDP as part of their services. These partnerships can help streamline the DDP process and ensure sellers meet their international customers’ expectations.

Practical Tips for Sellers Using DDP

For sellers using Delivered Duty Paid (DDP), understanding the complexities of shipping, customs clearance, and cost management is essential to a successful transaction. Here are some practical tips for sellers looking to optimize their DDP operations and avoid potential pitfalls:

- Choose Reliable Shipping Partners

When using DDP, the seller bears the responsibility for delivering goods to the buyer's location, including the risk of damage or delays during transit. Choosing reliable shipping carriers with experience in international logistics is key to ensuring timely and secure deliveries. Sellers should:

- Work with well-established shipping companies that have experience in handling international DDP shipments.

- Ensure insurance coverage: Make sure that goods are insured for their full value while in transit. This will protect the seller in the event of damage or loss.

- Hire Experienced Customs Brokers

Navigating customs regulations in different countries can be challenging, particularly if sellers are unfamiliar with the import laws of the destination country. Hiring a customs broker who specializes in DDP shipments can help ensure smooth customs clearance and avoid costly delays. A customs broker can:

- Assist with completing the necessary paperwork and ensuring the correct HS codes are used.

- Handle communication with customs authorities to resolve any issues or disputes.

- Research Local Laws and Regulations

Understanding the specific customs and tax regulations in the buyer’s country is crucial for ensuring compliance and avoiding unexpected costs. Sellers should:

- Research the applicable import duties, taxes, and fees in the destination country before quoting a DDP price.

- Be aware of any special documentation requirements or import restrictions that may apply to the goods they are shipping.

- Use Tools to Calculate Duties and Taxes

Accurately calculating the cost of import duties, taxes, and other fees is essential when offering DDP. Sellers should use tools and software that can help them estimate these costs upfront. Several online tools and platforms are available that provide up-to-date information on import duties and VAT rates in different countries. - Maintain Clear Communication with Buyers

Clear communication with buyers is critical to ensuring a successful DDP transaction. Sellers should:

- Confirm the delivery address and any special delivery requirements with the buyer before shipping the goods.

- Provide tracking information so buyers can monitor the progress of their shipment and be prepared for the final delivery.

- Plan for Contingencies

Despite careful planning, unforeseen issues such as customs delays, inspections, or increased tariffs can arise in DDP shipments. Sellers should build in some flexibility to their delivery timelines and be prepared to handle these contingencies. This could involve maintaining relationships with customs agents or having a plan in place for rerouting shipments if necessary.

By following these practical tips, sellers can mitigate the risks associated with DDP transactions and ensure a smooth, hassle-free delivery experience for their buyers.

Conclusion

Delivered Duty Paid (DDP) is one of the most comprehensive and buyer-friendly Incoterms available in international trade. By taking on full responsibility for shipping, customs clearance, import duties, and delivery, sellers can provide a seamless, hassle-free purchasing experience for buyers. However, DDP also places a significant burden on the seller, requiring careful planning, cost management, and expertise in customs regulations.

While DDP is an excellent option for industries like e-commerce, luxury goods, and heavy machinery, sellers must weigh the benefits against the challenges of managing complex international transactions. With the right logistics partners, customs brokers, and tools to calculate costs, sellers can successfully navigate the complexities of DDP and build stronger relationships with their global customers.

As international trade continues to evolve, DDP remains a valuable tool for sellers looking to expand their reach and offer a premium, all-inclusive service to buyers around the world.